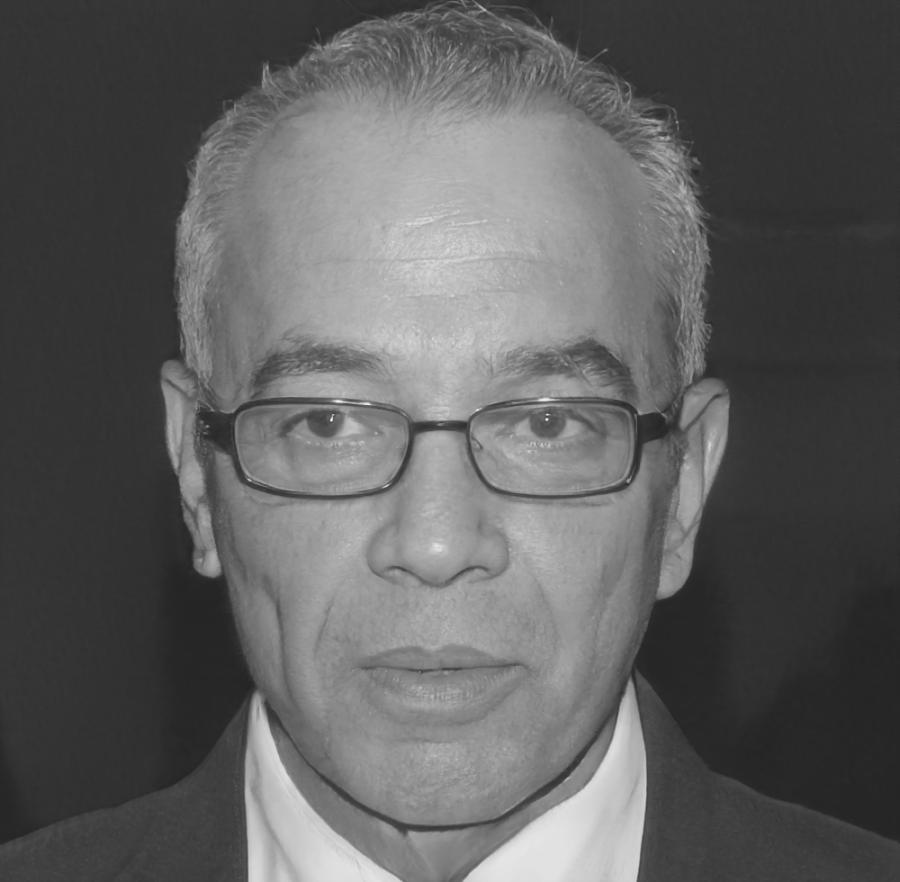

Eamon Lindqvist

Lead Financial Analyst

Spent eight years at regional investment firms before joining us in 2022. Gets frustrated when financial reports hide information in complexity — which happens more than you'd think.

Most proud of: Building our sector-specific comparison frameworks that account for regional market differences across Southeast Asia. Standard Western metrics often miss crucial local context.